give the gift of life-changing summer camp experiences

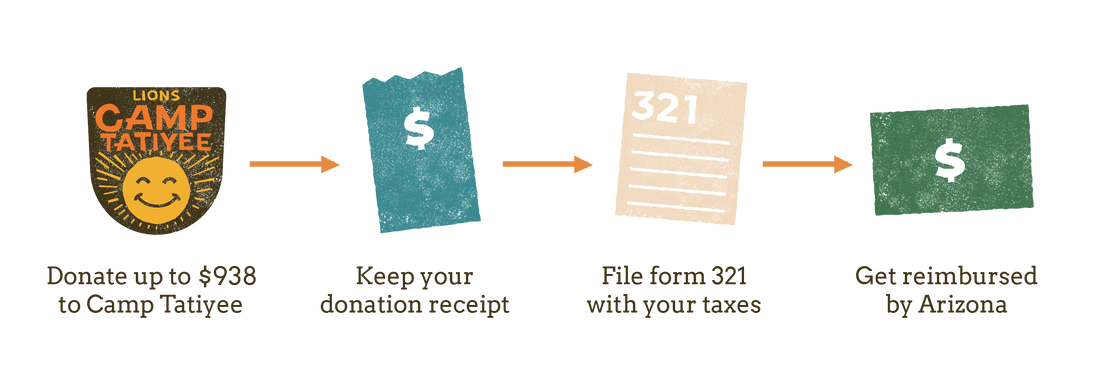

You can make a donation to Camp Tatiyee of up to $470 as a single tax filer or $938 as a couple, and get every dollar of your donation back when you file your state taxes! Please note that these amounts have increased in 2024.

Camp Tatiyee's Qualified Charitable Organization (QCO) code is 20677.

Camp Tatiyee's Qualified Charitable Organization (QCO) code is 20677.

frequently asked questions

How does the Arizona Charitable Tax Credit Work?

When you file your Arizona taxes, as a single or a couple, you can claim a dollar-for-dollar Arizona Charitable Tax Credit that will either reduce your tax liability or increase your refund. It's a simple and easy way to donate at no cost to yourself.

All you need to do is complete AZ form 321 or give Camp Tatiyee’s QOC Code 20677 to your tax preparer.

All you need to do is complete AZ form 321 or give Camp Tatiyee’s QOC Code 20677 to your tax preparer.

What is the Arizona Charitable Tax Credit?

The State of Arizona allows a donor to take a dollar-for-dollar tax credit on your state taxes. When you donate to a qualified charitable organization like Camp Tatiyee, you can receive a tax credit up to $470 as a single filer, or $938 as a married couple filing jointly.

Please note that these amounts were recently increased from their previous amounts of $421 and $841, respectively. This tax credit was previously known as the Working Poor Tax Credit.

Please note that these amounts were recently increased from their previous amounts of $421 and $841, respectively. This tax credit was previously known as the Working Poor Tax Credit.

Which organizations can i give to and get the tax credit?

The State of Arizona has recognized Camp Tatiyee as a Qualified Charitable Organization (QCO). That means all the donations you make special needs campers can be used to claim the Arizona Charitable Tax Credit, up to the $470 or $938 limit.

What will my gift be used for?

Your gift will be used exclusively to provide life-changing summer camp experiences to campers with special needs across the state of Arizona. Due to the nature of the tax credit, 100% of all tax credit donations go toward direct service, meaning your entire donation is being used to support a child with special needs!

What if I already take the school tax credits or another tax credit

The Arizona Charitable Tax Credit does not conflict with the Education Tax Credit or the Foster Care Credit. You can make donations through each of these tax credit as long as you have a tax liability.

How do I get the tax credit when I file my taxes?

All you need is Camp Tatiyee’s QCO code: 20677. Submit this when you file your taxes and you will receive your credit.

Do I need to itemize my taxes to claim the tax credit?

No, you do not need to itemize your taxes to claim the Arizona Charitable Tax Credit. You can fill out the AZ Form 321 and still claim the credit.

When do I need to make my gift to qualify?

You can make your gift up until the tax deadline, typically April 15th.

Can I donate my tax credit by giving cash or check?

Absolutely, Camp Tatiyee encourage you to give in the way that feels most comfortable for you! In order to make a donation by mail, cash or check, please download our tax credit form at the button below: